Guide to the Foreign Subsidies Regulation, part 4: Fines and other penalties

The obligations under the FSR aren’t purely technical. They are formal requirements, and failure to comply can lead to serious legal and financial consequences. Non-notification, submitting incomplete or inaccurate information, or delay in responding to a request from the European Commission can result in a high fine or other monetary penalty, a ban on conducting a concentration, or exclusion from a public procurement proceeding.

In this part of the guide, we explore the risks of non-notification or submission of erroneous data, and the sanctions that can be imposed by the Commission.

What duties can be infringed, and what is subject to sanctions?

Undertakings covered by the Foreign Subsidies Regulation must exercise the greatest care in performing their informational obligations, both when filing notifications (on form FS-CO for concentrations or FS-PP for procurement procedures), and when submitting information requested by the Commission.

Acts or omissions that may be found to infringe the FSR can be divided into three groups.

-

Infringement of notification obligation

Notification of a planned concentration (form FS-CO) or participation in a procedure for award of a public contract (form FS-PP) is a fundamental obligation under the FSR. Non-notification, late notification, or carrying out a transaction without the prior approval of the Commission can have serious consequences.

Infringements include the following:

- Failure to make a mandatory notification despite achieving the notification thresholds (e.g. EUR 500 million of turnover in the EU or EUR 50 million in contributions from third countries in the case of concentrations, or in the case of public procurement a contract value of EUR 250 million and EUR 4 million in contributions)

- Filing a late notification (e.g. after concluding a merger agreement or after the deadline for submitting tenders in a procurement)

- Concluding a transaction without prior approval of the Commission (i.e. violating the standstill rule).

Example

Company X, based in the EU, acquires company Z without first notifying the transaction to the Commission, despite exceeding both of the thresholds set forth in the FSR (high turnover and significant financial contributions from a third country). The Commission may impose a fine of up to 10% of X’s total annual turnover for infringing the notification obligation.

-

Infringement of duty to provide information

Apart from notifications on form FS-CO or FS-PP, the FSR provides for a broad duty to cooperate with the Commission, at the formal stage of proceedings and during the course of ex officio review or inspection. Submitting inaccurate data or failing to respond may result in serious financial sanctions.

Infringements include:

- Supplying incomplete, incorrect or misleading information requested by the Commission

- Failing to provide (complete) information sought in an inspection

- Producing the required books and records in incomplete or inadequate form

- Non-cooperation, including ignoring a request for information or evading questions from the Commission (e.g. during the course of ex officio review).

Example

During the course of a procedure, the Commission requests an undertaking seeking a public contract to provide detailed data on the terms of a loan it received from a sovereign fund from outside the EU. The undertaking fails to provide the information on time and does not justify the delay. The Commission may impose a periodic penalty payment of up to 5% of the undertaking’s daily turnover for each day of delay, until the required information has been fully submitted.

-

Preventing or hindering inspection

The FSR vests the European Commission with the authority to conduct investigations and inspections, including site visits, searches, document requests, and interrogation of staff. Failure to cooperate with the Commission at this stage is also subject to administrative sanctions.

Infringements include:

- Refusal to submit to an inspection (e.g. blocking access to premises or IT systems)

- Providing incomplete documents or information during an inspection

- Violating the terms of the inspection, e.g. restricting activities to selected areas or individuals

- Hindering the Commission’s contact with the undertaking’s staff, including individuals with relevant information.

Example

During an ex officio proceeding the Commission requests an undertaking to conduct an inspection at the premises of a subsidiary outside the EU where documents concerning foreign subsidies are stored. The undertaking does not admit inspectors from the Commission to the location in question and refuses to provide access to the information. This can result in imposition of a fine as well as a periodic penalty payment until the inspection is allowed.

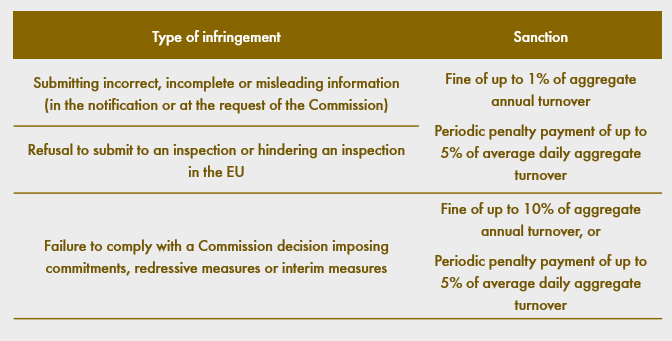

What are the potential penalties for infringing informational obligations?

Non-compliance, whether intentional or negligent, may lead to imposition of administrative sanctions in the form of:

- One-off fines of 1% to 10% of the undertaking’s aggregate turnover in the preceding financial year, depending on the violation, or

- Periodic penalty payments of up to 5% of the average daily aggregate turnover for each day of the ongoing infringement.

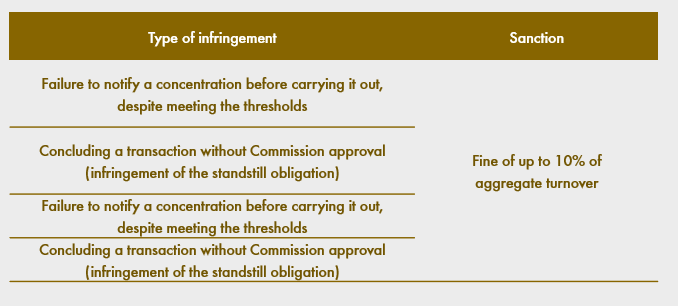

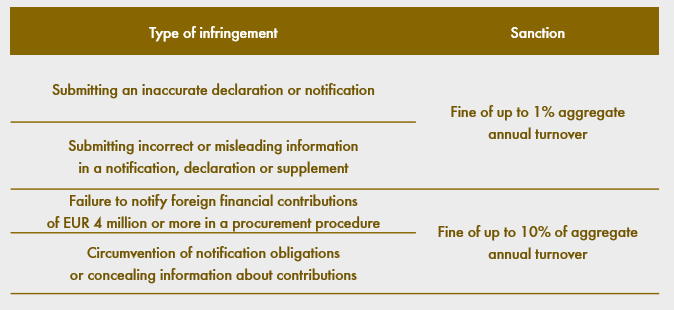

The amount of the sanction depends on the type and seriousness of the infringement. It can also differ depending on whether it involves a concentration, participation in a public procurement procedure, or non-cooperation.

When setting the sanction, the Commission takes into account the nature, gravity and duration of the infringement, as well as the principles of proportionality and appropriateness.

Below we provide a breakdown of the most common infringements and the potential sanctions.

Infringements involving both concentrations and procurement

Infringements involving concentrations (form FS-CO)

Infringements concerning public procurement (form FS-PP)

What happens if the Commission finds a distortion of the internal market?

If the Commission finds as a result of analysis of a notification (form FS-CO or FS-PP) or in an ex officio proceeding that a financial contribution from a third country distorts or may distort the internal market, the Commission may:

- Accept commitments offered by the undertaking, which the Commission deems appropriate and sufficient to fully and effectively remedy the distortion, or

- Impose redressive measures proportional and adequate to remedy the distortion in the internal market.

Examples of redressive measures:

- Offering access under fair, reasonable, and non-discriminatory conditions to infrastructure (e.g. research facilities) acquired or supported by foreign subsidies

- Reducing capacity or market presence (e.g. by a temporary restriction on commercial activity)

- Divestment of certain assets or refraining from certain investments

- Licensing on fair, reasonable and non-discriminatory terms of assets acquired or developed with the help of foreign subsidies

- Publication of R&D results

- Requiring the undertakings to adapt their governance structure, or dissolve the concentration

- Repayment of the foreign subsidy, with interest.

The Commission may also prohibit the concentration or award of the public contract, if appropriate redressive measures are not proposed or implemented.

Interim measures

If there are sufficient indications that a foreign subsidy distorts the internal market and there is a risk of serious and irreparable damage to competition, the Commission may issue a decision imposing interim measures. If required by the urgency of the situation, such a decision may even be adopted without first hearing the undertaking, but then the undertaking has a subsequent right to address the decision.

Interim measures will apply for a specific period, which may be renewed, or until a final decision is taken. Such measures may include, for example:

- Providing access under fair, reasonable, and non-discriminatory conditions to infrastructure (e.g. research facilities) acquired or supported by foreign subsidies

- Refraining from certain investments

- Licensing on fair, reasonable and non-discriminatory terms of assets acquired or developed with the help of foreign subsidies.

Example

A Chinese undertaking which has received significant financial support from the government of a third country plans to acquire a European manufacturer of semiconductors. The Commission launches an ex officio investigation because it has serious doubts concerning the impact of the foreign subsidy on competition and the security of supplies in the EU. During the investigation, the Commission finds that European customers may be excluded from access to the acquired infrastructure, which poses a danger of distortion of the market.

Due to the risk of irreparable damage to competition, before the Commission completes its full analysis it issues a decision imposing interim measures and orders the undertaking to ensure access to the manufacturing infrastructure under fair, reasonable and non-discriminatory terms until the proceeding is completed.

In practice—how to avoid sanctions?

To minimise the risk of fines or other negative decisions, it is worth applying certain best practices from an early stage of an M&A transaction or preparations for a tender.

Prepare in advance:

- Identify all affiliated entities (holding companies, subsidiaries, joint ventures) and draw up a map of the links within the group

- Gather data on financial contributions over the past three years, including forms that may not be obvious, such as tax incentives, guarantees, research support, etc

- Engage the finance and compliance functions, as well as counterparties, particularly subcontractors and consortium members.

Assess the risk of market distortion:

- Does a foreign subsidy provide an advantage that cannot be achieved under market conditions?

- Would other entities on the market have access to comparable support?

- Is the advantage proportional to the purposes and the costs it is intended to compensate?

Be proactive:

- If you identify a risk, considering presenting to the Commission the positive effects of the financial contribution for the EU market (e.g. employment, investments, innovations)

- If necessary, propose redressive measures to limit the potential distortion of the market and enable the Commission to issue a conditional decision instead of a ban.

Don’t ignore the FSR, even if the other party or the contracting authority doesn’t mention it:

- In public procurement, the notification obligation arises under the regulation itself, not the tender documentation. Lack of an indication in the contract announcement or terms of reference does not relieve contractors of the notification obligation. And in the case of M&A, a failure by the other party to require notification is not an excuse.

Summary

The FSR has formally been in force since mid-2023, and the duty to notify concentrations or participation in public procurement procedures went into effect on 12 October 2023. But we can already make a few key observations from the European Commission’s practice and the market’s response:

-

The scale of notifications has exceeded expectations

The first year of the FSR being in force showed that the new rules are having a real impact on commercial practice. Through the end of October 2024, the Commission received over 100 formal notifications concerning concentrations and 1,108 notifications in the public procurement context. A more comprehensive assessment will come later, as the Commission says it plans to publish its first annual report on implementation of the FSR at the end of 2026.

-

The early decisions show flexibility by the Commission

In the case of acquisition of a part of PPF Telecom by e& (from the United Arab Emirates), the Commission accepted commitments involving such issues as exclusion of an unlimited state guarantee and restricting the financing of PPF’s operations in the EU. This example shows how the Commission may apply redressive measures in specific cases.

-

Impact of launch of proceedings on decisions by contractors

In October 2023 the Commission initiated an investigation into the Chinese company CRRC Qingdao Sifang Locomotive, which was participating in a tender to supply trains to the Bulgarian public rail operator. The investigation involved alleged foreign subsidies that could distort competition. In response to the Commission’s move, the Chinese company withdrew from the tender.

-

Focus on strategic sectors

The investigation of the planned investment by BYD (from China) in an electric vehicle factory in Hungary shows that the Commission examines particularly closely projects in sectors key to the EU’s strategic autonomy—such as electromobility, semiconductors, and green technologies.

The experience to date shows that the Foreign Subsidies Regulation is an instrument actually being applied in practice, and is not just theoretical. For businesses, this means a need to change their approach. Now an assessment of the impact of foreign financing on competition in the EU should be a part of any major M&A deal or participation in any large public tender.

Strategic preparations for meeting the disclosure obligations, early analysis of financial contributions, and informed communications with the European Commission may not only help avoid sanctions, but also help achieve market success.

Dr Anna Kulińska, Serom Kim, adwokat, State Aid & EU Internal Market practice, Wardyński & Partners